OECD/EUIPO report sheds more light on a global trade worth nearly half a trillion dollars

It is, of course, notoriously difficult to provide accurate statistics on an industry that is founded on fraud and deception.

Why even bother? Well, both the public and private sectors need reliable information on the wider impact of counterfeiting to be able to allocate scarce resources to dealing with the issue. Without a decent understanding of the nature and extent of the problem, decisions are based on mere speculation.

In November 2015, we examined the European's Commission's report on EU Customs' seizures for 2014. The OECD/EU IPO has now released a comprehensive analysis of more than 500,000 Customs seizures recorded globally between 2011 and 2013. This is a significant report, as it's the first comprehensive global study since OECD's last report in 2008.

Researchers examined the WCO's dataset of global Customs seizures, complemented by data from the EU and US. Customs seizures statistics present one of the better sources of data. Despite only a fraction of consignments crossing borders being detained, the data is objective and fairly reliable.

]

The headline conclusions from the OECD/EUIPO report are:

- Counterfeit and pirated goods ("fakes") are one of the largest contributors to the global "underground economy", similar to the estimated value of the trade in illegal narcotics.

- The scale of the trade in fakes is "almost too hard to comprehend". The total value of imported fake goods worldwide was nearly half a trillion dollars in 2013, or around 2.5% of all global imports.

- In the EU, that percentage is even higher (at up to 5% of imports) reflecting the impact of fakes on developed, innovation economies.

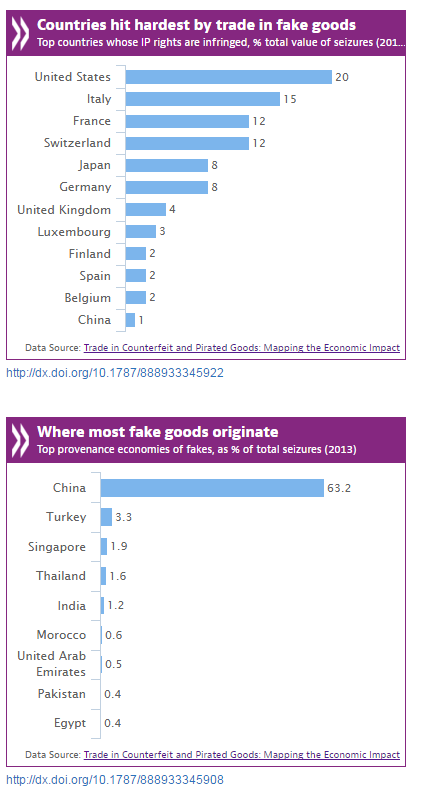

- Brands owned by US, Italian and French companies were the hardest hit.

- In many cases, the proceeds of counterfeit trade went towards organised crime.

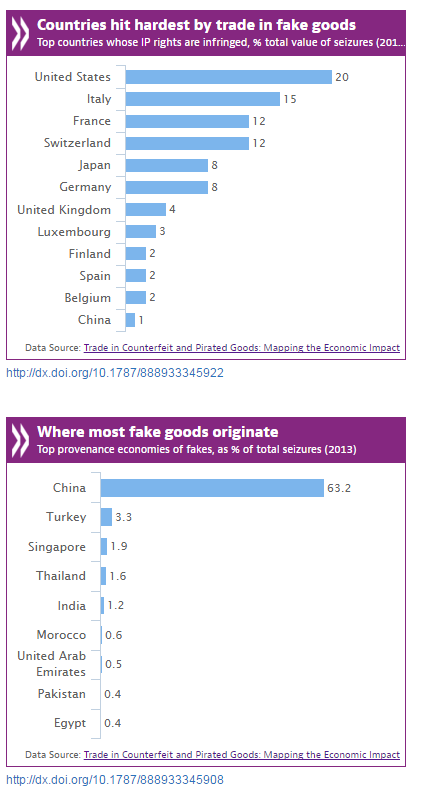

- Most fake goods originated in middle inc

- me or emerging countries, with China still the top producer.

- However, China isn’t singled out a source alone. The data shows that IP rights of Chinese companies are also frequently infringed and represent 1.4% of all goods seized. Unless checked, this will undermine the innovative efforts of Chinese companies relying on knowledge-based capital and IP rights.

- The share of small shipments, mostly by post or express parcels, is growing and accounted for 62% of seizures over 2011-13. This trend clearly reflects the growing importance of e-commerce and its attractiveness to those trading in fakes.

- Fake goods pass through complex routes via major trade hubs such as Hong Kong, Singapore and UAE. The report reveals that trade routes change significantly from year to year as those trading in counterfeits exploit new "weak spots".

[Source: Trade in Counterfeit and Pirated Goods - Mapping the Economic Impact]

OECD Deputy Secretary-General Doug Frantz said, “The findings of this new report contradict the image that counterfeiters only hurt big companies and luxury goods manufacturers. They take advantage of our trust in trademarks and brand names to undermine economies and endanger lives.”

Our opinion

- It has been notoriously difficult to estimate the scale of counterfeiting and its impact on the global economy. While it cannot give the "full" picture, the report is a welcome step forward and is more comprehensive than any previous study.

- The report shows that the international trade in fake goods is evolving at an alarming rate and is more sophisticated than ever.

- Counterfeiters adapt quickly and those rights holders best equipped to deal effectively with this phenomena have real time data to hand on cases, targets and the latest trends threatening their businesses.

- The growing importance of e-commerce and the delivery of fakes to consumers by parcel post suggests that the solution is not to be found in one country or region alone, but in a joined up global approach.